National Assembly Highlights Barriers to Affordable Credit

RENUKA RAI | Thimphu

Rural borrowers in Bhutan continue to face challenges in accessing loans despite recent reforms aimed at standardizing bank interest rates and land valuation practices.

The Economic and Finance Committee (EFC) of the National Assembly presented its review report on 11 December 2025, focusing on the impact of variations in commercial bank lending rates and discrepancies between government and bank land valuations on public access to credit.

The findings highlight persistent gaps for rural borrowers and emphasize the need for continued oversight and coordinated action among key agencies.

The review was initiated following a directive from the preliminary meeting of the National Assembly held on 3 November 2025, after concerns were raised about difficulties faced by citizens in accessing affordable credit.

The committee’s report examined the root causes of interest rate variations, assessed their impact on borrowers, and analysed how land valuation practices affect lending in rural areas.

The review also looked at the effectiveness of recent reforms, including the Minimum Lending Rate (MLR) and the Common Land Base Rate (CLBR 2025), and proposed actionable steps to improve access to loans nationwide.

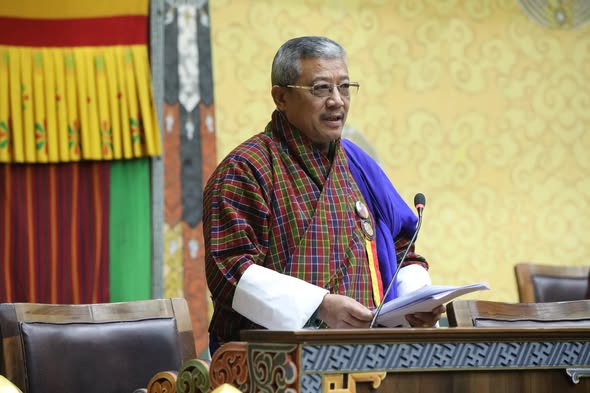

The MP from the Gelephu constituency, Harka Singh Tamang, on behalf of EFC, presented a comprehensive review report on bank interest rates and land valuation practices, highlighting key challenges affecting public access to credit, particularly in rural areas on 22 December.

One of the main issues highlighted in the report is the variation in bank interest rates. The committee found that differences in rates across commercial banks result from their assessments of operational costs, credit risk, and strategic priorities.

While the Royal Monetary Authority (RMA) has introduced a standardized framework and revised the MLR to provide a baseline, inherent differences in risk between urban and rural loans mean that interest rates will continue to vary.

Rural borrowers are particularly affected because loans in these areas are considered higher risk due to weaker land markets and lower collateral liquidity. The committee noted that while regulatory measures have increased transparency, they have not yet significantly reduced the financial burden on rural borrowers.

The second major concern identified is discrepancies in land valuation practices.

The Property Assessment and Valuation Agency (PAVA) values land for administrative purposes, including taxation and transaction fees, while banks evaluate land based on its ability to serve as collateral, focusing on liquidity and marketability.

This difference has created challenges for rural borrowers. Although the CLBR 2025 has helped harmonize valuations in urban and semi-urban areas, rural valuations remain problematic.

Bhutan Development Bank (BDBL), which serves mainly rural clients, continues to use conservative valuation methods from 2017 due to weak land markets and unsold pledged collateral.

This often results in loans that are lower than the land’s administrative value, limiting access to funding for productive activities such as farming or small businesses.

The committee emphasized that the core issue lies in the gap between policy intent and operational realities. Policies aim to use land as productive collateral to support credit access, but in rural areas, land is often illiquid. This forces banks to devalue collateral, which contradicts administrative valuations and restricts borrowing capacity.

At the same time, while standardizing interest rates and land valuations provides transparency and fairness, financial institutions must retain the flexibility to manage risk in diverse economic contexts. Balancing standardization with risk differentiation is therefore essential to ensure both fairness and viability in the banking system.

To address these challenges, the Committee has requested that the RMA, Ministry of Finance, PAVA, and BDBL submit a joint action plan by July 2026.

The plan is expected to outline measures for improving transparency in lending decisions, harmonizing land valuations across regions, and strengthening support for rural borrowers.

A follow-up review during the winter session will assess the progress of these initiatives and report back to the National Assembly. Continuous oversight is considered critical to ensure that reforms achieve meaningful results for all citizens.

Currently, work is ongoing. The RMA is addressing interest rate consistency, while the Ministry of Finance and PAVA are reviewing land valuation methods to better support rural lending.

The committee noted that these efforts are important initial steps, but achieving equitable access to credit across Bhutan will require ongoing coordination and careful monitoring.

The report also highlights the broader issue of financial inclusion. Access to credit is not only about interest rates or land valuations; it is about creating a system where rural citizens can access loans to support livelihoods, small businesses, and productive activities.

While urban borrowers may benefit from active land markets and predictable collateral values, rural borrowers face structural challenges that cannot be solved by regulation alone.

The committee stressed that achieving financial inclusion requires policies that are both practical and adaptable to the realities of rural lending.

While reforms such as the revised MLR and CLBR 2025 represent progress in standardizing the financial system, rural borrowers continue to face barriers. Interest rate variations and differences between administrative and bank land valuations limit borrowing opportunities and affect economic development in rural areas.

The committee’s report highlights the need to reconcile policy objectives with market realities, ensuring that standardization does not impede the ability of banks to manage risk while maintaining fair access for all borrowers.

The EFC’s review reflects the National Assembly’s commitment to creating a financial system that is transparent, fair, and inclusive.

By monitoring the implementation of reforms and coordinating actions among key agencies, the government aims to ensure that rural borrowers are not left behind and that credit access becomes more equitable across Bhutan.

While urban borrowers have begun to benefit from these reforms, the report makes it clear that rural borrowers still struggle to obtain adequate loans for farming, small businesses, and other productive activities.

Addressing these challenges requires sustained effort, careful oversight, and collaboration between financial institutions and government agencies.

The committee’s recommendations aim to create a framework where interest rates are reasonable, land valuations are transparent, and all citizens can access the credit they need to participate fully in the nation’s economic development.

The report also underlines that policy alone is not enough; its effectiveness is measured by real-life outcomes. Rural borrowers, who form a significant portion of Bhutan’s population, need practical improvements in credit access.

Through continued reforms, action plans, and monitoring, there is hope that the financial system can better support rural communities, promote economic growth, and ensure equitable opportunities for all citizens.

The committee report presented to the National Assembly on Monday, 22 December 2025, makes it clear that while steps have been taken to standardize lending practices and land valuations, rural borrowers still face challenges.

The government’s ongoing efforts to harmonize interest rates, improve valuation methods, and strengthen oversight are critical to bridging the gap between policy intent and operational reality.

With coordinated action and continuous monitoring, Bhutan aims to build a financial ecosystem that is inclusive, transparent, and equitable, ensuring that all citizens urban and rural alike can access affordable credit to support livelihoods and development.

The Committee is directed to submit for a follow up review in the winter session considering further consultation with stakeholders.