Government revenue for FY 2025-26 is expected to reach Nu. 73.2 billion while expenditure is set at Nu. 119.2 billion

TIL BDR GHALLEY | Thimphu

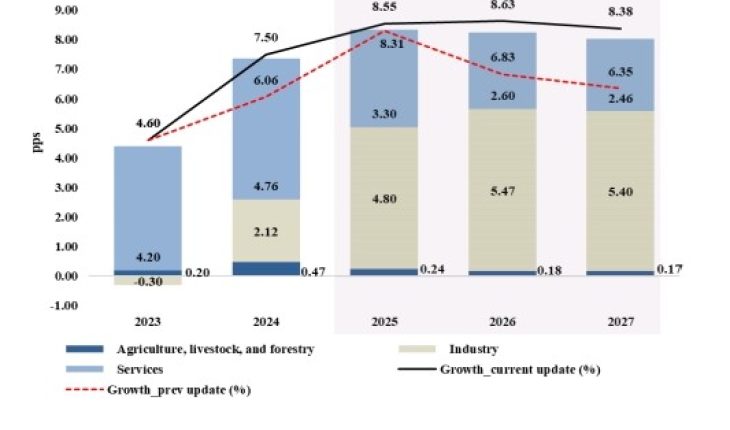

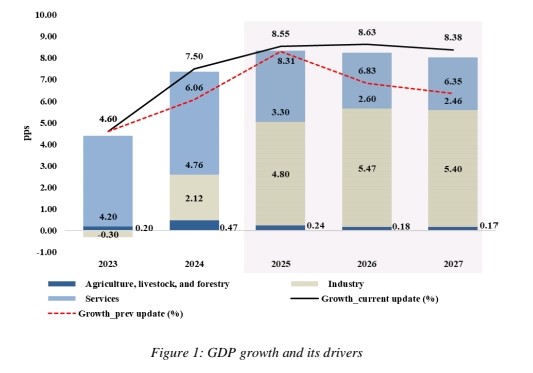

According to the Macroeconomic Situation Report (Fourth Quarter Update, FY 2024-25) released by the Ministry of Finance. economy is projected to grow by 8.55 percent in FY 2025.

The projection is supported by robust industrial growth and a strong performance in the services sector.

However, despite this optimistic forecast, the report highlights continued fiscal pressures, external imbalances, and persistent youth unemployment.

The services sector including wholesale and retail trade, hotels, restaurants, finance, and transport—emerged as the primary driver of economic expansion.

Industry is projected to grow by 15.80 percent, mainly due to hydropower-related activities, although delays in the Dorjilung and Khorlochu projects tempered momentum.

Agriculture, livestock, and forestry posted modest growth of 1.94 percent, a slowdown compared to 2024.

“Growth remains primarily driven by construction activities in the hydropower sector,” the report states, noting that services had outperformed projections because of tourism recovery and higher disposable incomes following pay revisions in the public sector.

In 2024, Bhutan’s economy grew by 7.5 percent, surpassing earlier projections. The growth trajectory is expected to remain strong, maintaining above 8 percent through 2027.

In addition, unemployment rate is expected to average 2.9 percent in 2025, down from 3.5 percent in 2024. However, youth unemployment remains high at 17.9 percent and is projected to remain close to 20 percent in the medium term.

The report cautioned that “persistent high youth unemployment reflects structural mismatches between qualifications and available jobs,” with the issue concentrated in urban areas.

Domestic revenue for FY 2024-25 was estimated at Nu. 62,208 million, falling short of expectations due to delayed dividends and profit transfers from Punatsangchhu-II.

The implementation of the Goods and Services Tax (GST) in 2026 is expected to boost revenue, generating an estimated Nu. 14,000 million in its first year.

Total expenditure stood at Nu. 89,308 million in FY 2024-25 and is projected to increase by over 33 percent in FY 2025-26.

For the first time, capital expenditure will surpass current expenditure, reflecting an expansionary policy aligned with the 13th Five Year Plan (FYP).

The fiscal deficit was recorded at 2.5 percent of GDP in FY 2024-25 and is expected to widen to 5.2 percent in FY 2025-26 and 5.6 percent in FY 2026-27.

Public debt amounted to Nu. 303,965 million, equivalent to 100.5 percent of GDP, and is projected to rise further with hydropower-related borrowings. Hydropower loans currently account for nearly 56 percent of the total debt.

The money supply contracted by 2.63 percent compared to the previous quarter, reaching Nu. 247,197 million in FY 2024-25.

Liquidity after the Cash Reserve Requirement stood at Nu. 29,058 million, though it is expected to decline in FY 2025-26.

Credit growth increased by 14 percent, totaling Nu. 251,266 million, largely directed toward hotels, tourism, manufacturing, and housing.

Non-Performing Loans (NPLs) reached Nu. 8,375 million as of May 2025, with the housing, trade, and commerce sectors bearing the highest concentrations.

The Royal Monetary Authority (RMA) introduced targeted restructuring measures to address repayment pressures, moving away from blanket deferments.

Inflation stood at 3.65 percent in June 2025, down from the previous month’s 3.85 percent but higher than 2.13 percent in June 2024.

The moderation was largely due to lower food and communication prices, though the report noted inflationary pressures remain amid global trade uncertainties.

The balance of payments is projected to record a surplus of Nu. 25,031 million in FY 2025-26, a 4.7 percent improvement from earlier forecasts, supported mainly by inflows in the financial account.

The Current Account Deficit (CAD) remained high at 14.5 percent of GDP in FY 2024-25 and is forecast at 12.7 percent in FY 2025-26.

The merchandise trade deficit widened due to rising imports of vehicles, construction materials, and machinery. However, future export growth from ferrosilicon plants expected to commence in 2026 is anticipated to improve trade performance.

Foreign reserves stood at USD 816.5 million in FY 2024-25 and are projected to reach USD 1,112.9 million in FY 2025-26, adequate to cover 29 months of essential imports.

The report emphasized continued dependence on hydropower as a major risk, alongside widening fiscal and current account deficits.

“Persistent high levels of CAD, combined with fiscal deficits, could lead to macroeconomic instability in the coming years,” it warned.

Policy recommendations outlined in the report include diversifying growth drivers through tourism and niche manufacturing, enhancing fiscal efficiency, reforming the financial sector, and promoting non-hydro exports to reduce vulnerabilities.

Bhutan’s economy is forecast to maintain growth above 8 percent through 2027, anchored by hydropower expansion, tourism recovery, and public investment.

Government revenue for FY 2025-26 is expected to reach Nu. 73.2 billion, up 17.7 percent from the previous year, while expenditure is set at Nu. 119.2 billion.

The report concluded that the successful implementation of the 13th FYP, diversification of the economic base, and effective policy reforms will be critical to translating short-term gains into long-term inclusive growth.