Rising reliance on imported cereals, dairy, and oils underscores urgent need for domestic production and food security strategies

TIL BDR GHALLEY | Thimphu

Bhutan’s agricultural imports have surged significantly over the past five years, underscoring the country’s growing dependence on foreign food supplies despite national goals of self-sufficiency.

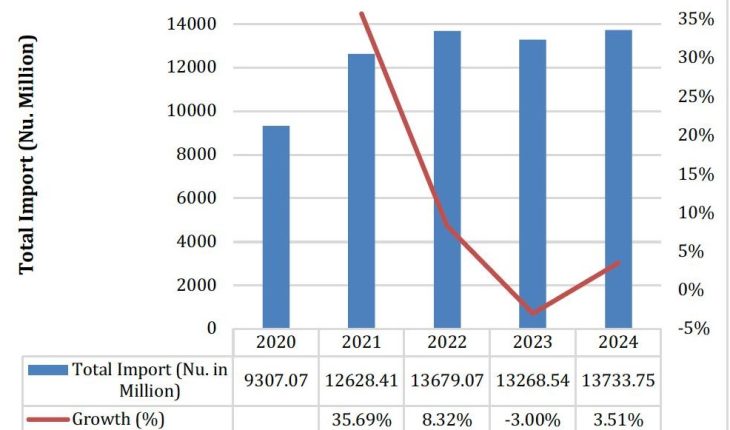

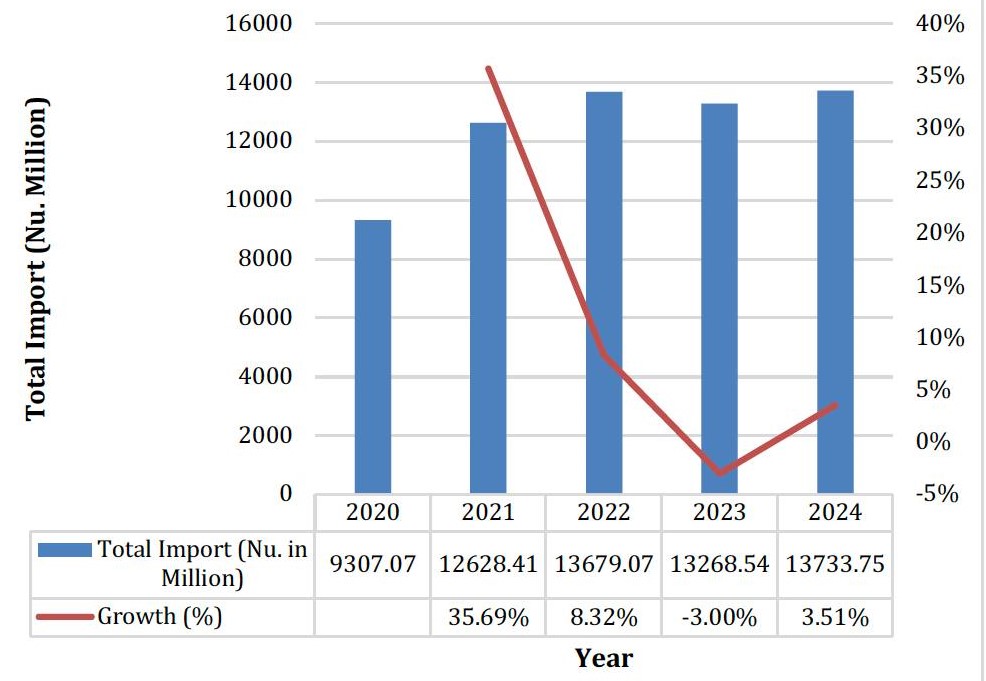

According to the Import of Agricultural Products in 2024 and Trend in the Five Years (2020–2024) report published by the Department of Agricultural Marketing and Cooperatives (DAMC) in September 2025, total agricultural imports reached Nu. 13.73 billion in 2024, marking a 3.5 percent increase from the previous year.

The report, compiled by a team from DAMC in collaboration with the Department of Revenue and Customs (DRC) and the Ministry of Agriculture and Livestock (MoAL), shows that agricultural imports have grown steadily from Nu. 9.3 billion in 2020 to Nu. 13.7 billion in 2024.

The sharpest rise occurred in 2021, when imports increased by 35.7 percent, a trend attributed to stockpiling during the COVID-19 pandemic.

In 2024, imports were dominated by cereals, dairy products, edible oils, and animal-based foods.

Rice remained the single largest imported commodity, totaling 61,098 metric tonnes (MT) valued at Nu. 2.91 billion, almost entirely sourced from India. Maize followed closely at 51,529 MT, worth Nu. 1.3 billion, again largely imported from India.

Soya bean oil, a major source of edible oil, accounted for 11,337 MT valued at Nu. 1.3 billion, while other animal and vegetable fats totaled 4,138 MT worth Nu. 462 million.

These figures highlight Bhutan’s dependence on India, which supplies more than 90 to 95 percent of the country’s agricultural imports.

“India has emerged as the dominant source across almost all commodities,” the report states, warning that the concentration of imports from a single country “presents likely risks of supply disruption and price volatility.”

The report notes that dairy products form a substantial portion of Bhutan’s agricultural imports. Imports of milk and cream stood at 13,237 MT (Nu. 1.05 billion), while cheese and curd amounted to 1,585 MT (Nu. 697 million).

Milk powder imports, although smaller in quantity at 581 MT, had a high value of Nu. 226 million. The rise in dairy imports reflects growing domestic consumption that outpaces local production capacity.

Similarly, meat imports remain significant. Bovine meat imports in 2024 totaled 1,296 MT (Nu. 362 million), while frozen chicken imports reached 1,784 MT (Nu. 293 million). “These figures underscore the limited capacity of domestic livestock production to meet demand,” the report notes.

Imports of fish amounted to 2,710 MT, valued at Nu. 515 million, sourced mainly from India, Thailand, and Vietnam. Wheat flour, another key staple, recorded 10,650 MT worth Nu. 411 million, with nearly all supplies coming from India.

Other significant imports include lentils (2,128 MT; Nu. 173 million), betel leaves (807 MT; Nu. 206 million), and onions and shallots (4,496 MT; Nu. 199 million). Malt, used primarily by Bhutan’s beverage industry, reached 5,262 MT (Nu. 235 million), also entirely imported from India.

Between 2020 and 2024, Bhutan’s import structure showed consistent reliance on three main categories: cereals, dairy, and edible oils. Cereals accounted for over 31 percent of agricultural imports in 2024, followed by dairy products (16 percent) and fats/oils (15 percent).

Rice imports remained the top item throughout the period, peaking at 94,601 MT in 2023, valued at Nu. 3.1 billion, before declining in 2024. The report attributes this drop to higher global prices rather than improved domestic production.

Maize imports more than doubled, increasing from 18,803 MT in 2020 to 51,529 MT in 2024, while the value surged from Nu. 291 million to Nu. 1.3 billion.

Soya bean oil imports remained steady in volume but fluctuated in value due to price volatility, peaking at Nu. 1.63 billion in 2021 before easing to Nu. 1.3 billion in 2024.

Dairy imports grew consistently over the period. Milk and cream imports rose from 8,936 MT (Nu. 801 million) in 2020 to 13,237 MT (Nu. 1.05 billion) in 2024. Cheese and curd imports also climbed steadily.

Imports of animal and vegetable fats nearly tripled — from 1,514 MT in 2020 (Nu. 130 million) to 4,138 MT in 2024 (Nu. 462 million). The report describes this as one of the fastest-growing categories, reflecting “rising consumption of processed oils and fats.”

Wheat flour imports remained relatively stable in quantity but rose in value, suggesting higher import prices over time.

Similarly, fish imports grew from 1,899 MT in 2020 to 2,710 MT in 2024, with value increasing by nearly 50 percent.

While meat imports remain high, both bovine and poultry imports showed volatility. Bovine meat peaked at 2,007 MT (Nu. 415 million) in 2023 before falling sharply to 1,296 MT (Nu. 362 million) in 2024.

Frozen chicken imports followed a similar pattern, declining from 2,286 MT in 2022 (Nu. 388 million) to 1,784 MT in 2024 (Nu. 293 million).

Vegetable imports also fluctuated. Onions and shallots peaked at 6,330 MT in 2022, before dropping to 4,496 MT in 2024, while lentil imports declined steadily from 3,008 MT in 2021 to 2,128 MT in 2024.

The DAMC report highlights several important takeaways. Bhutan’s import basket remains heavily concentrated in cereals, dairy, and oils. India continues to supply more than 90 percent of the country’s total agricultural imports.

Bhutan’s 13th Five Year Plan aims to double agricultural exports from Nu. 3 billion to Nu. 6 billion by 2029, aligning with the broader goal of reducing dependency on imports.

The DAMC report provides data-driven insights to guide such efforts, emphasizing the need for “enhanced domestic production capacity, better market linkages, and improved logistics.”

While Bhutan’s reliance on Indian imports continues to meet its immediate consumption needs, the report cautions that without policy interventions and investment in local agriculture, “growing dependence on imported value-added goods may undermine food sovereignty.”