KINZANG DORJI TSHERING | Thimphu

The report, prepared by the Department of Macro-Fiscal and Development Finance, provides a detailed overview of Bhutan’s external and domestic debt, sovereign guarantees, debt servicing obligations, and risk indicators.

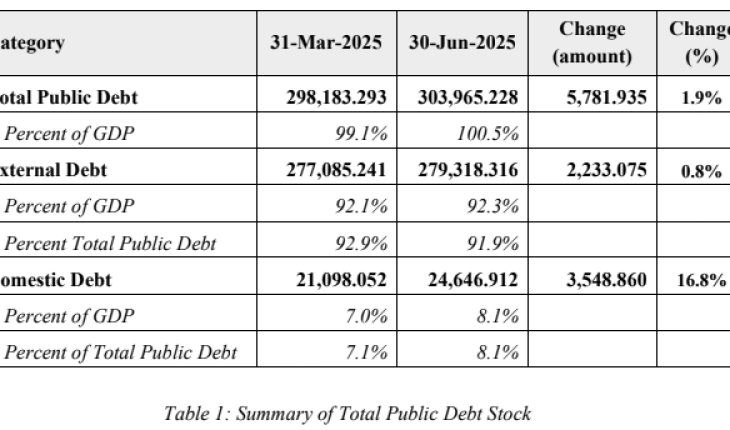

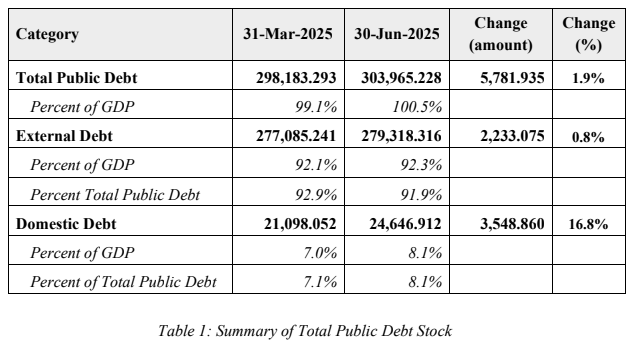

The total debt comprises external borrowings of Nu. 279,318.316 million, representing 91.9% of the total public debt, and domestic debt of Nu. 24,646.912 million, accounting for 8.1%.

Central government debt, which finances the non-hydro budget deficit, stands at Nu. 111,984.602 million, equivalent to 37% of GDP, remaining within the 55% GDP limit prescribed under the Public Debt Management Policy 2023.

Compared to the previous quarter, total public debt increased by Nu. 5,781.935 million, a 1.9% rise, with external debt up by Nu. 2,233.075 million and domestic debt rising by Nu. 3,548.860 million.

Government borrowings constitute Nu. 252,460.794 million, or 90.4% of external debt, followed by corporate debt at Nu. 16,857.522 million (6%) and central bank debt of Nu. 10,000 million (3.6%).

Hydropower projects remain the largest component of external debt, amounting to Nu. 170,087.648 million, which is 56.2% of GDP and 60.9% of total external debt.

These loans fund major projects including Punatsangchu I & II, Mangdechu, Dagachu, Basochu, and other small hydropower initiatives. Non-hydropower debt totals Nu. 109,230.667 million and finances budgetary needs, commercial projects, and central bank borrowings.

India remains Bhutan’s largest external creditor, accounting for 64% of total external debt, followed by the Asian Development Bank at 17% and the International Development Association at 13%.

Other multilateral and bilateral creditors, including IFAD, JICA, and SBI/EXIM Bank, account for the remaining 6.2%. In sectoral terms, hydropower projects account for 60.9% of external debt, while budgetary support from multilateral lenders constitutes 19.3%.

The remaining debt finances infrastructure, rural electrification, agriculture, road connectivity, trade and urban development, and social sectors such as education and health.

Bhutan’s domestic debt stock stands at Nu. 24,646.912 million, equivalent to 8.1% of GDP. This includes government bonds amounting to Nu. 21,098.052 million and an overdraft facility from the Bank of Bhutan of Nu. 3,548.860 million.

Existing government bonds include 2-year to 12-year maturities issued between 2021 and 2023, with a total outstanding of over Nu. 21 billion.

Total debt servicing in FY 2024-25 is projected at Nu. 11,603.859 million, with external debt service at Nu. 10,315.720 million and domestic debt service at Nu. 1,288.138 million.

Debt service to domestic revenue is estimated at 17.4%, well below the 35% ceiling stipulated under the Public Debt Management Policy.

External debt service as a percentage of exports is projected at 10.9%, reflecting manageable repayment obligations relative to export earnings.

The debt portfolio’s risk profile is considered moderate. Fixed-interest-rate loans comprise 95.4% of total debt, and the average time to maturity is 10.8 years, limiting refinancing risks.

Hydropower loans are structured with repayments starting only after project commissioning, and revenue from electricity exports to India ensures adequate coverage.

The remaining 31.6% of external debt is concessional convertible currency loans with long grace periods and nominal interest rates, further mitigating liquidity risks.

Outstanding government-guaranteed loans as of 30 June 2025 amount to Nu. 3,575.397 million, representing 1.2% of GDP.

Guarantees include funding for the National Housing Development Corporation, Bhutan Agro Industries, Drukair Corporation, and other public entities.

Most guarantees, such as the National Credit Guarantee Scheme, have expired without invocation, reflecting low contingent liability risks.

Sonam Tobden, a recent graduate from Thimphu, shared his views on the rising public debt: “Seeing that our public debt has crossed 100% of GDP is quite concerning. I worry that it might impact taxes or government spending on essential services.”

He, however, acknowledged that many of these loans are for hydropower, which could benefit the country in the long run.

When asked about hydropower loans specifically, Sonam added, “Hydropower projects seem promising because they generate revenue through electricity exports to India. I hope these projects continue to be successful so that the debt doesn’t become a burden on citizens.”

Sangay Tenzin, a high school teacher in Paro, commented on government guarantees and debt transparency: “I wasn’t fully aware of all the government guarantees, but knowing that loans are backed by the state does make me cautious. It’s reassuring that most guarantees haven’t been invoked, which suggests risks are low.”

On the importance of transparency, Sangay said, “I think it’s very important for the government to report public debt clearly. Citizens should know how money is borrowed and spent so we can hold decision-makers accountable.”

The Ministry of Finance noted that while total public debt exceeds 100% of GDP, the debt structure is largely manageable due to the commercially viable nature of hydropower projects, the peg of INR debt, concessional borrowing terms, and long maturity profiles.

Elevated repayments in FY 2026/27 are expected due to the Standby Credit Facility with India, but overall debt servicing remains sustainable.

The report underscores the government’s commitment to transparency and sound debt management, providing quarterly updates that help maintain fiscal discipline and public confidence.