KINZANG DORJI TSHERING

Thimphu

While the nominal amount of debt has increased slightly, there has been a significant improvement in the country’s debt-to-GDP ratio, which dropped from 109.8% to an estimated 99.1% of Gross Domestic Product (GDP).

Finance Minister Lyonpo Lekey Dorji, while presenting the annual budget report to the National Assembly, highlighted that the government remains committed to maintaining a prudent and sustainable debt profile.

“Our borrowing is guided by the Public Debt Management Policy 2023, which sets clear limits and safeguards to ensure debt remains within manageable levels,” Lyonpo said adding, the central government debt currently stands at 35.5 percent of GDP, comfortably below the 55 percent ceiling established in the policy.

The Ministry of Finance (MoF) reported that external debt rose to Nu 277.09 billion in 2025, up from Nu 261.12 billion in 2024. This increase is largely attributed to ongoing financing of large-scale infrastructure and energy projects, particularly in the hydropower sector.

Meanwhile, domestic debt declined significantly, dropping from Nu 31.97 billion to Nu 21.10 billion. This reduction reflects a combination of active repayments and strategic debt restructuring initiatives aimed at optimizing the government’s overall borrowing costs and maturity profiles.

Despite the increase in total borrowings, Finance Minister Lekey Dorji reassured lawmakers and citizens alike that Bhutan’s debt levels remain manageable.

“Over 95 percent of our borrowings are on fixed interest terms, and the average maturity is over 11 years, which helps insulate us from global interest rate volatility,” he said.

He added that this conservative borrowing strategy underscores Bhutan’s efforts to shield its economy from unpredictable external shocks that have impacted many developing countries in recent years.

Hydropower continues to be the largest contributor to Bhutan’s external debt, although its share has gradually decreased. As of March 2025, 61.4% of external debt was linked to hydropower projects, down from 64.1% the year before.

Lyonpo Lekey emphasized that hydropower debt should be seen as investment debt—funds deployed to build productive assets that will generate long-term revenues. He pointed to ongoing projects such as the Punakha Hydroelectric Project and the Dorjilung Hydropower Project, which are expected to start yielding revenue in the coming years.

Although some projects have faced delays due to unforeseen challenges, the government remains optimistic about their eventual contribution to Bhutan’s energy export revenues, which are a vital source of foreign exchange earnings.

Meanwhile the government debt also showed signs of improvement. It represented 35.8% of total public debt in March 2025, down from 36.6% a year earlier.

Measured against GDP, Central Government debt fell from 40.2% to 35.5%, reflecting prudent fiscal management and strict adherence to the 2023 debt policy guidelines.

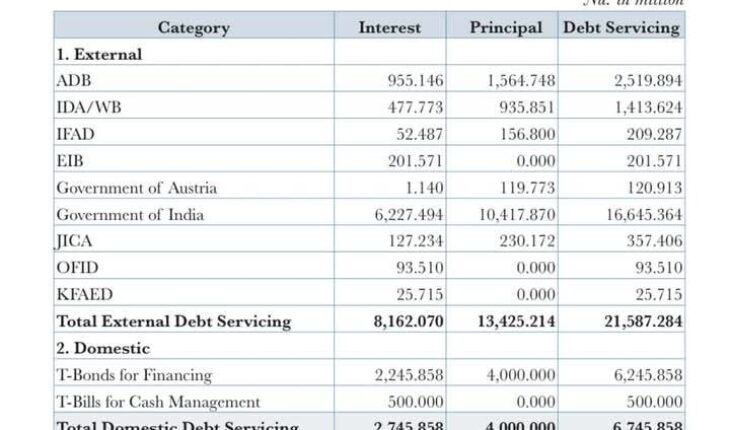

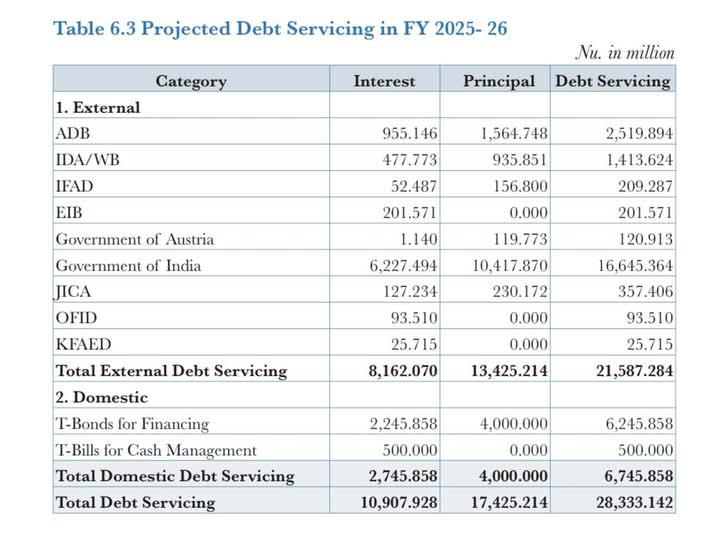

On the fiscal front, debt servicing costs rose in nominal terms, with Nu 13.3 billion allocated for the current fiscal year. This includes Nu 10.6 billion in external debt service and Nu 2.6 billion for domestic repayments.

Despite these higher payments, the debt service-to-domestic revenue ratio is projected to decrease slightly from 24.0% to 22.3%. This ratio, according to the report, remains well within the 35% ceiling set by Bhutan’s fiscal framework.

Meanwhile, Bhutan’s total public debt is projected to rise to Nu 474.42 billion by the end of the 13th Five-Year Plan period, which spans 2024 to 2029. This increase would represent approximately 94.8% of projected GDP.

The Ministry of Finance is upbeat that this trajectory is sustainable and consistent with Bhutan’s broader development strategy.

Nonetheless, officials stress that Bhutan’s debt profile differs significantly from many other developing economies, mainly because of its concessional borrowing terms, long repayment horizons, and focus on financing productive investments.

“Our debt structure is long-term, concessional, and aimed largely at sectors that will generate future revenues and socio-economic benefits,” the finance minister noted.

He added that this approach minimizes vulnerability to debt distress and ensures that borrowed funds contribute meaningfully to economic growth and poverty reduction.

Bhutan’s external borrowing landscape continues to be shaped by strong partnerships with multilateral and bilateral lenders. The Government of India remains the largest creditor, accounting for approximately 65.5% of Bhutan’s external debt.

Following India, the Asian Development Bank (ADB) and the International Development Association (IDA) are significant creditors, representing 17% and 13% of external debt respectively.

These institutions provide Bhutan with low-interest, long-term loans that finance a range of projects, from improving education and rural livelihoods to upgrading urban services and transport infrastructure.

Other lenders include the Japan International Cooperation Agency (JICA), the International Fund for Agricultural Development (IFAD), and the Export-Import Bank of India.

These concessional loans have been instrumental in funding Bhutan’s key development projects, including schools, healthcare centres, rural road networks, and renewable energy initiatives.

“Our debt management is not simply about limiting borrowings but ensuring that every Ngultrum borrowed supports sustainable and inclusive nation building,” Lyonpo Lekey emphasized.

While a formal Debt Transparency Portal is yet to be launched, the government is exploring ways to enhance transparency and public engagement in debt management. Plans are also underway to introduce new platforms that would improve public access to information on loan terms, repayment schedules, and fund utilization.

The report states that while Bhutan’s public debt has increased modestly in absolute terms, its relative burden on the economy has declined due to robust economic growth and disciplined fiscal management.

“The debt structure remains fiscally prudent, with long-term, concessional loans focused on productive sectors. With strong governance, strategic borrowing, and a growing economy, Bhutan appears well-positioned to manage its public debt challenges effectively and sustainably.”

This disciplined approach to borrowing is expected to support the government’s vision of transforming Bhutan into a self-reliant, high-income country by 2034.